Quarterly Newsletter

New liability fields to support split limit coverage

Filers will have more flexibility when entering liability limits

Published: January 11, 2023

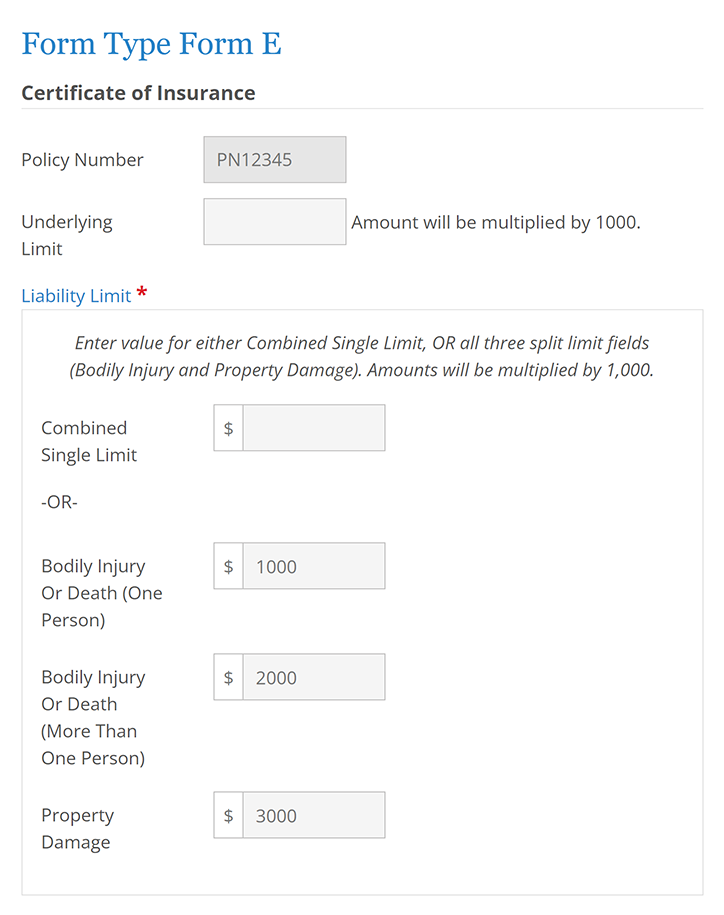

NIC Insurance Filings continues to look for ways to make our system more practical and valuable for our insurance filing users. With our latest release of enhancements, filers will see expanded options when entering liability coverage. Insurers can now enter a combined single limit or split limits.

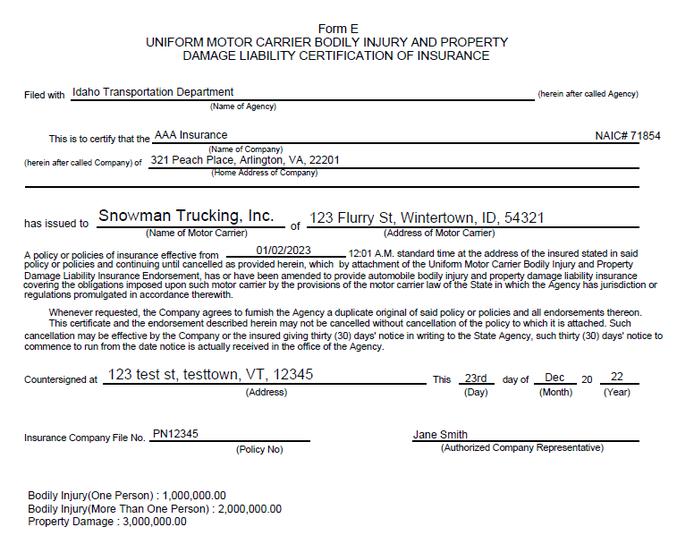

Insurers that provide split limit coverage can enter separate liability limits for bodily injury per person, bodily injury total per accident, and property damage per accident. When entering split limit coverage information, all three fields are required. Amounts entered in these fields will be multiplied by 1,000.

The pre-existing combined single limit liability coverage field will continue to be available. When entering a combined single limit coverage, the split limit fields must be left blank. Error messages will appear if a filing contains both types of liability data.

The PDF certificate of the Form E filing will show the new split limit information or the combined single limit information.

The new split limit coverage fields will be available for filings to all states. Please review all information for accuracy and verify that it meets the state's minimum financial responsibility and filing requirements prior to submission.

This was an enhancement suggested by a current insurance user of our system. We hope this improved flexibility will provide a more user-friendly experience and be supportive of insurance users' needs. Please reach out to us if you have any comments, suggestions, or questions.